Leadership

Kary Nordholz

Prior to founding Broad Street Investment Partners, Mr. Nordholz was a Senior Vice President of Investments at Bell Partners, a leading U.S. multifamily investment firm. He was responsible for all acquisition, disposition, and related financing activity for the Eastern United States. Prior to joining Bell Partners, he was a Principal at Ares Management, a global investment firm, where he was responsible for all investment activity in the Southeastern United States as well as Ares’ industrial investment platform nationally.

Mr. Nordholz has been responsible for transaction activity valued at $5.5 billion throughout the United States, including investing in over 28 million square feet of industrial space and 14,000 multifamily units.

Mr. Nordholz holds an MBA with distinction from The Leonard N. Stern School of Business at New York University and a BBA in Finance from the University of Georgia.

Michael Bartlett

Prior to founding Broad Street Investment Partners, Mr. Bartlett was a Principal at Ares Management, a global investment firm. He was responsible for leading industrial investment activity across the U.S. value-add fund series as well as multifamily investment within the southeast for both value-add and development transactions.

Mr. Bartlett has been responsible for transaction activity valued at $5.1 billion throughout the United States, including investing in over 43 million square feet of industrial space and 13,500 multifamily units.

Mr. Bartlett holds a BBA in Real Estate from the University of Georgia.

Investment Experience

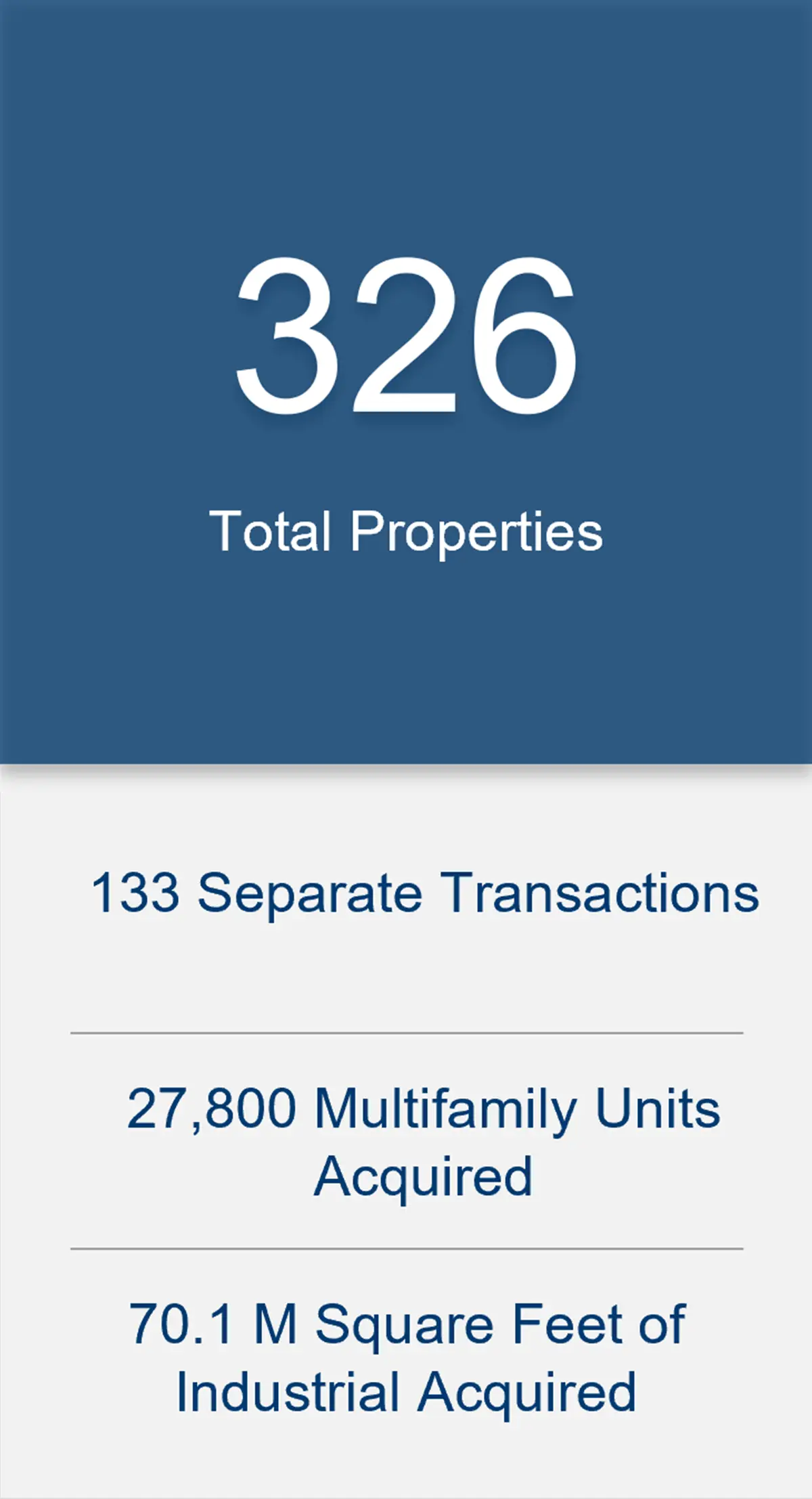

Broad Street Investment Partners’ principals have been responsible for over $10.6 billion in transaction volume across the United States, including $7.6 billion in acquisitions and developments and $3.0 billion in dispositions. Broad Street’s principals have closed 133 separate transactions in 37 different markets totaling 326 properties.